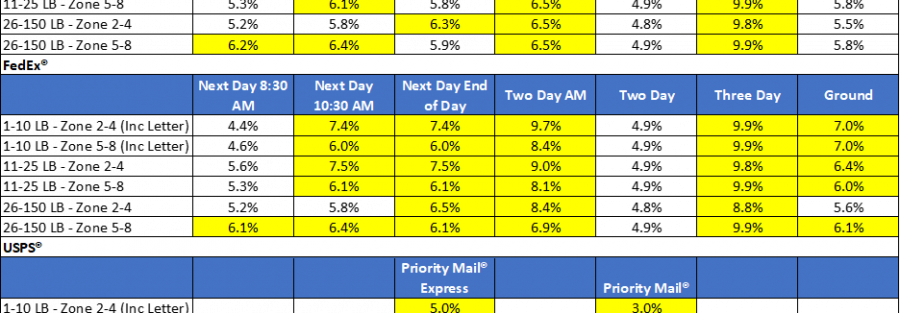

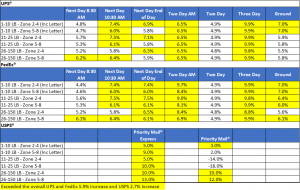

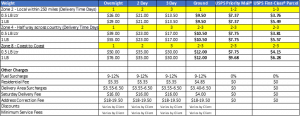

With inflation and our reliance on document and parcel delivery at their peak, this January, the carriers have all raised rates to their highest levels. While we expect increases, this year is one of the largest and it is important to understand the impact so you can properly budget or look for other savings alternatives. Both UPS® and FedEx® announced that they were having a 5.9% increase, but this is overall. Based on the multiple factors, the actual increase could be significantly higher as you can see in the chart below. Also, the USPS® stated that their Priority Mail® rates were going up 2.7%, but again this is overall. Most clients should expect to see higher increases. In this article, we will go over these changes, educate you on how rates are calculated and provide savings strategies that can help minimize the financial impact.

There are three main factors that determine the rate of the item. The service level (based on delivery objectives), the zone it is going (Distance away from where it is being sent) and the weight. In the chart above, we break out zone 2-4 (Less than 600 miles) vs. zone 5-8 (Over 600 miles) because many organizations send most of their items to local clients vs. across the country. We also break out the weights because we find that many shipments are less than 10 LBs, which would include documents and small parcel. We highlighted the areas in yellow that are higher than the carriers listed increases. As you can see, based on what and where you are sending, the increases could be much larger. Overall, we are seeing higher increases for the lighter weight items going to local zones.

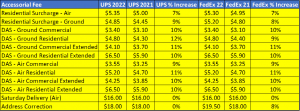

Accessorial Fees

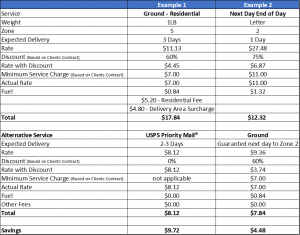

When we analyze our client’s carrier invoices, we typically find that 20-30% of their bill is made up of accessorial charges, also called value added services. The rates of these fees have also gone up considerably and need to be factored. The chart shows a subset of some of the most common fees. We highlight these because they are some or the most frequent and the USPS does not charge for these services. It is important to focus on Delivery Area Surcharges (DAS) because 61% of all zip codes in the US are assessed these fees. These zip codes are viewed as less densely populated areas where the carriers charge $3.40 to $6.50 added to the cost of the parcel.

Comparing Costs

The chart above shows the rate comparison for the different service options for all three carriers. The base rate tables for UPS and FedEx are very similar and we find the biggest difference is your negotiated contract. Regular shippers will have 25-85% discounts off listed pricing tables and will pay much lower amounts than what is shown above. The item to be careful with is the Minimum Service Fees. This states that no matter what your discount percent is, you can never go below a specific price floor. This is important for lighter weight items because you will typically not get the full discount percentage as you can see from the examples below. Also, while you may be getting the best rate with UPS and FedEx for heavier items (Where you can take the full discount) and items going to densely populated businesses, this may not be the case for lighter items when it is to residential customers or rural areas.

In Example 1 (See below): You are sending a lightweight item to a residential address. The list price of the Ground shipment is $11.13 and even though the client has a 60% Ground discount, they have a minimum Service Charge of $7 negating $2.25 ($7-4.45) of their discount. When you add the Fuel Surcharge of 12%, the $5.20 Residential Fee and the $4.80 Delivery Area Surcharge, the item is $9.72 more than sending Priority Mail® from the USPS that would have the same delivery objective.

Example 2: An additional savings strategy is to consider your carriers guaranteed Ground service for items in specific zones as an alternative to their air options because it can offer a significant savings and the same or faster delivery:

- Overnight items in Zone 2 (Local)

- Two day items in Zone 2 and 3

- Three Day items in Zone 2, 3 and 4

As you can see, both items will get there at the same time, but the Ground option is $4.48 less.

Most clients are using free carrier provided shipping tools (UPS CampusShip®, UPS.com, FedEx.com) that make it difficult to make these comparisons. They will not have USPS rates and the Ground comparison are typically not displayed next to their air counterparts making it difficult to see these as an option. We recommend having multi carrier shipping tools that can display the rates for all options in one screen to make it easy for your users to make the best shipping decisions. We find this type of rate shopping can reduce costs in the 4-12% range and can help offset the annual increases in carrier rates.

Dimensional Rates

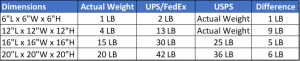

Dimensional weight is a major area that clients need to understand that can drastically increase their bills. Often clients either are not entering the dimensions of their piece or are not considering the impact to the size of the box when they are making shipping decisions. UPS and FedEx will dimensionally rate items starting at about a 6” cube. The formula is Length x Width x Height (In inches)/139. Example: Box that is 12” x 10” x 6” that is 3 LBs would need to be rated at 6 LBs. The USPS does not dimensionally rate items until the L x W x H is greater than 1728 or one cubic foot and they divide the number by 166 (Instead of 139) making them lower calculated weights. In this example, the item would be at the actual weight of 3 LBs. The chart below gives several comparisons of the difference in weight between the private carriers and the USPS. This will increase the number of items that are less expensive through the Post Office.

Conclusion

The carriers are going to continue to raise rates at higher levels than we have seen in the past. Our reliance on delivery is increasing and there are very few major suppliers who have increased leverage. Clients have less bargaining power in carrier rate negotiations and fewer shipping costs are being passed back to the end recipient. The best way to reduce expenses is have ways to compare the rates across multiple carriers and service levels at the point of shipment. You need to have the right tools in place that help your end users make the best decisions on a package-by-package basis. The free carrier tools will not provide this level of detail and it is not practical to expect users to shift between multiple systems to make these decisions. The good news is with the right tools there are ways save money and offset these increases.